Choose the Right Bookkeeping Partnership for Your Business

Selecting the right level of support is essential for your business health.

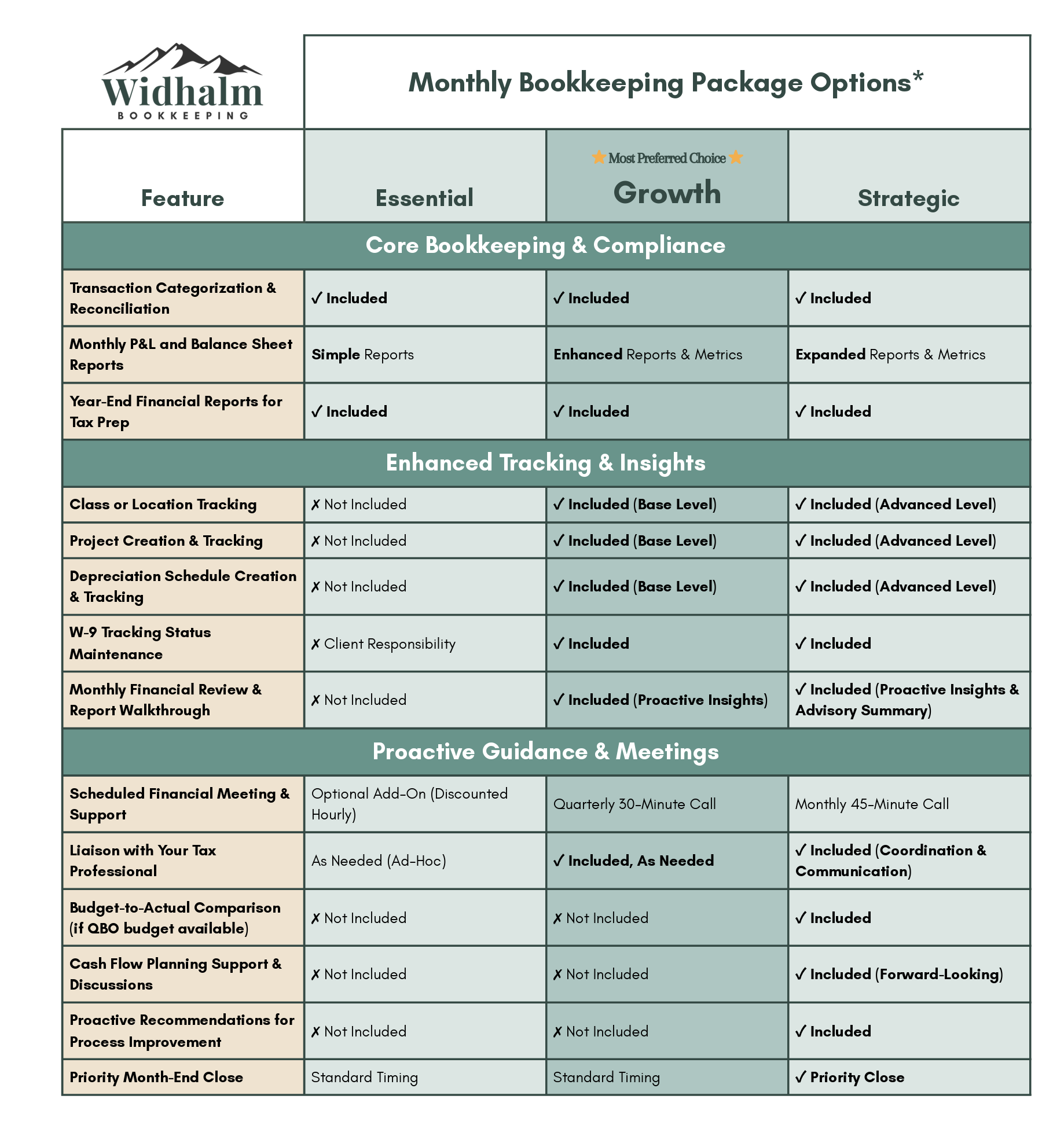

We offer three distinct monthly bookkeeping tiers designed to meet you where you are—from core tax compliance to proactive financial partnership.

While our Essential package provides solid tax readiness, most of our growing clients find the Growth package to be the perfect fit, offering the proactive insights and enhanced tracking needed to truly understand your financials and stay ahead of the curve. Review the chart below to find the tier that aligns with your goals.

*Eligibility and Customization: While our service packages are designed to cover the needs of most businesses, our focus remains on providing accurate, high-integrity financial records. For this reason, our firm reserves the right to assess a business's complexity, volume of activity, and scope of needs to determine service eligibility. If a business's requirements exceed the scope of the Essential package, we will recommend the appropriate higher-tier package to ensure the quality and completeness of your books. Packages, scope, and pricing are subject to review every six months.We designed our packages to simplify your financial management journey. Here is a brief summary of who each tier is best for:

Essential Monthly Bookkeeping: This tier is ideal for new or established business owners whose primary goal is accurate, compliant books for tax time. It covers core transaction tracking and reconciliations but is purely a record-keeping service with minimal discussion or advanced tracking.

Growth Monthly Bookkeeping (Our Recommended Starting Point): This is the sweet spot for business owners looking to move from simple compliance to proactive financial management. It includes enhanced tracking features (Class, Project, Depreciation), monthly detailed reporting with trend observations, and a scheduled quarterly meeting to keep you informed and help you spot issues early.

Strategic Monthly Bookkeeping & CAS: This premium tier is for businesses seeking an ongoing financial partner and strategic advisor. It offers monthly high-touch advisory meetings, comprehensive cash flow support, and process improvements, designed for significant growth and maximum financial insight.

-

Every business has unique needs, and our services are tailored to meet those needs. Here's a small sample of what we offer our clients:

☑️ Customized Chart of Accounts

☑️ Transaction Categorization

☑️ Necessary Journal Entries

☑️ P&I Tracking on Notes Payable

☑️ Tax Compliance Adjustments

☑️ Monthly Reconciliations

☑️ Quarterly Financial Reports

☑️ Quarterly check-in Zoom calls

☑️ Email Support

☑️ Coordination with Your Tax Preparer for a smooth tax season

-

Whether you're months—or even years—behind, we specialize in bringing messy or incomplete books up to date quickly and accurately.

This service is perfect for you if:

You haven’t kept up with your bookkeeping and tax time is looming

You’ve switched bookkeepers or DIY’d for a while and need a reset

You’re applying for a loan or funding and need clean financials

You want accurate books before moving into monthly services

Here is a sampling of how we can help!

Transaction categorization and reconciliation for past periods

Clean-up of duplicate, missing, or mis-categorized entries

Organization of Fixed Assets, Liabilities, etc.

Setup or correction of your Chart of Accounts

Cleanup Product/Services, Customers, Vendors, etc.

Reporting and recommendations to move forward with confidence

-

For a one time fee, let us set up your QBO account the right way, the first time! A 30 minute training session is also included.

-

Stay compliant and stress-free—let us handle the complexity of sales tax so you can focus on running your business.

Our Sales Tax Filing service includes:

Monthly, quarterly, or annual filings based on your state requirements

Accurate tracking and categorization of taxable vs. non-taxable sales

Registration and setup in your state’s sales tax system (if needed)

Timely submissions to avoid penalties and interest

Ongoing monitoring of filing deadlines and nexus thresholds

Multi-state filing support — if you file in more than five locations or have complex needs, we partner with TaxJar to ensure everything is handled with precision

-

We help you stay on top of your bills and maintain strong vendor relationships by managing your payables with accuracy and timeliness.

Our A/P services include:

Processing and recording vendor bills

Payment scheduling based on due dates and cash flow

Weekly or bi-monthly bill pay runs (via platforms like Relay, Bill.com, etc.)

Tracking and organizing vendor W-9s and preparing 1099s

Maintaining a clean and organized A/P ledger

Communication with vendors as needed

-

We keep your cash flow strong by helping you stay on top of what’s owed—and making it easy for your clients to pay on time.

Our A/R services include:

Creating and sending customer invoices

Setting up recurring invoices for retainer or subscription clients

Payment reminders and past-due follow-ups

Applying payments and reconciling deposits

Monthly A/R reporting so you know what’s outstanding

Support with platforms like QuickBooks, Keeper, or your CRM

-

Level up your business with Client Advisory Services (CAS)—financial insight that fuels smart growth.

As your trusted advisor, I go beyond bookkeeping to provide strategic guidance on budgeting, forecasting, cash flow, pricing, and data-driven decision-making. My CAS offering gives you the clarity and confidence to grow with purpose—without the overhead of a full-time CFO.

-

🤔 Not quite ready to hire a bookkeeper? Or maybe you just need to bounce around some ideas? Our consulting services might be perfect for you!

You can book an hour of one-on-one time for $100 to ask questions, get advice, or tackle specific bookkeeping challenges together.

Click here to book your consultation.